According to recent data from Secretary of State offices across hubs like Wyoming, Delaware, and Florida, the entrepreneurial spirit has evolved. We are no longer just seeing a "startup phase"; we are seeing a structural shift in how the American workforce operates.

It isn't just about "being your own boss." In 2026, the drivers are deeply rooted in these three new realities.

1. From Gig Economy to Solopreneurship

The 2026 surge is primarily driven by three distinct classes of entrepreneurs who prioritize a Limited Liability Shield over traditional employment:

The Fractional Leadership Boom

High-level executives are leaving the “C-Suite” to offer their expertise to multiple companies simultaneously.

These Fractional Leaders require an LLC structure to manage their multi-client contracts while protecting their personal assets.

Don’t just join the surge—profit from it. Calculate your 2026 LLC tax savings and liability value instantly.

LLC Surge: Financial Impact Predictor

See how an LLC structure changes your 2026 numbers.

The Creator & Micro-SaaS Economy

The barrier to entry for global commerce has vanished. From independent software developers to content creators, individuals are forming LLCs to professionalize their brand and access Pass-through Taxation benefits.

The “Safety Flight”

In a volatile economy, the LLC has become a flight-to-safety. Only founders use LLCs to create a legal “firewall” between their business risks and their family’s savings, ensuring the Corporate Veil remains intact.

2. How FinCEN BOI Fueled Growth

Interestingly, the introduction of stricter regulations—specifically the FinCEN BOI (Beneficial Ownership Information) reporting—has ironically accelerated filings.

As the Corporate Transparency Act became the new standard of LLC maintenance, founders rushed to establish their entities with professional assistance. The “Compliance Burden” of 2026 actually pushed hobbyists to become legitimate business owners.

Founders now realize that to stay compliant, they need more than just a name on a piece of paper; they need a Digital Domicile. This is where the synergy between a Registered Agent and a Virtual Business Address becomes the backbone of the surge.

3. Registered Agents as the New “Operational Gatekeepers”

In 2026, a Registered Agent is no longer just a statutory requirement for receiving Service of Process. They have evolved into critical operational partners.

With the surge in remote filings, the demand for a Professional Registered Agent who offers free mail scanning and digital compliance alerts has skyrocketed.

Founders are specifically seeking agents that provide:

- Anonymity: Using a registered agent’s address on public records to keep personal names out of the Knowledge Graph.

- Nexus Management: Helping remote LLCs navigate the complexities of Sales & Income Tax Nexus across state lines.

- Consistency: Providing a permanent Registered Office Address while the founder travels as a digital nomad.

Is your Registered Agent a compliance shield or a liability? Get your RA Efficiency Score before your next filing.

Registered Agent Efficiency Scorer

Does your current agent meet 2026 standards?

- Same-day Digital Mail Scanning

- Anonymity (Owner's name hidden)

- Compliance Alerts (BOI/Annual)

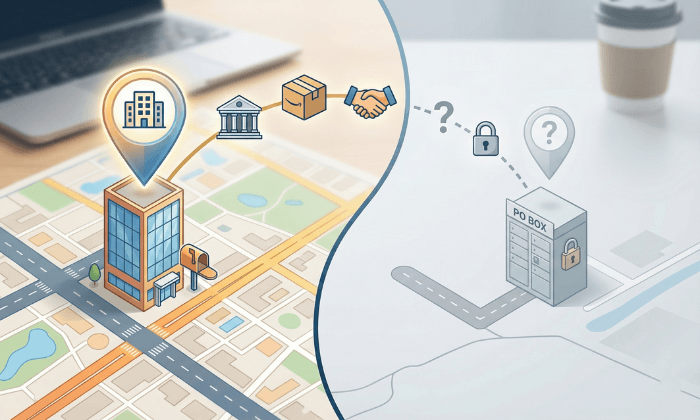

- Commercial Street Address (No PO Box)

4. The Rise of the Virtual Office

Business formation services are no longer just filing forms; they are building ecosystems. The surge has forced providers to integrate Virtual Mailbox technology directly into the formation process.

For a remote founder in 2026, the standard office lease is an obsolete overhead. The new “Headquarters” is a commercial street address provided by a CMRA (Commercial Mail Receiving Agency), such as PostScan Mail.

Why the 2026 Founder Chooses Virtual:

- KYC Compliance: Banks like Mercury and Relay have tightened their Know Your Customer rules. A real street address is mandatory to pass these checks.

- Amazon & Shopify Verification: E-commerce platforms now routinely audit addresses. A PO Box or a flagged “residential” address is an automatic rejection.

- Professional Image: A Manhattan or Cheyenne address carries weight in a proposal that “Apartment 4B” simply cannot.

The Strategic Decision Matrix

| Address Type | LLC Filing | Bank KYC | Amazon | Image | Corp. Veil Protection | Primary Strategic Benefit |

|---|---|---|---|---|---|---|

| Virtual Mailbox RECOMMENDED | ACCEPTED | VERIFIED* | APPROVED | Corporate | High: Clear separation of personal/business assets. | Location Independence & 100% Privacy Protection. |

| Home Address | ACCEPTED | ACCEPTED | ACCEPTED | Residential | Low: Blurs personal/business lines in court. | Simple physical compliance; zero privacy. |

| P.O. Box | REJECTED | REJECTED | BANNED | Basic | N/A: Invalid for legal entity formation. | Low-cost mail storage for non-legal use. |

5. The 2026 State Rivalry

While Delaware remains the gold standard for VC-backed startups seeking the predictability of the Chancery Court, Wyoming has emerged as the clear winner for the 2026 remote surge.

| Entity Goal | Recommended State | Primary Driver |

| Venture Capital | Delaware | Investor Preference |

| Extreme Privacy | Wyoming | Anonymous Filings |

| Local Services | Home State | Simplicity & Banking |

One state doesn’t fit all. Match your 2026 business goals to the perfect legal jurisdiction.

Fractional Founder Matchmaker

Find the best "Digital Domicile" for your 2026 strategy.

Ready to Join the Surge?

The business landscape has changed, but the foundation of success remains the same: Professionalism and Compliance.

Don’t let the 2026 regulatory environment slow you down. Secure your Registered Agent and Virtual Business Address today and launch your LLC with the confidence that your infrastructure is as agile as your vision.

Primary Compliance Sources

Note: This guide is updated weekly to reflect changes in Federal and State filing requirements.