Every financial team grapples with the constant uphill task of keeping businesses’ cash flow smooth. In an era where everything is moving towards automation, why should check depositing be any different?

Automated Check Deposit Services save businesses tons of difficulties from the traditional process of depositing checks at a bank.

Table of Contents

The importance of check deposit services for businesses

Despite rapid digitalization, several businesses rely on checks for their transactions. Manual check depositing, however, can be time-demanding and severely limit a company’s daily productivity.

Automated Check Depositing Services offer an efficient solution that improves cash flow management.

The shift towards automated check deposit services

streamlines depositing checks directly into your bank account without leaving your workplace, facilitating swift transactions, saving time, and reducing the risk of potential check fraud.

- Time-saving: Manual depositing at a bank is time-consuming, whereas automated check deposit services eliminate this time-cost process, freeing up precious hours for the workforce.

- Enhanced Safety: Manual transactions have a perpetual risk of check loss or fraud. Automated services considerably eliminate this risk, providing a secure transaction channel.

- Improved efficiency: Automated check depositing reduces human error and increases transaction accuracy. With such services, check depositing becomes quicker and more efficient.

The table below provides a concise recap:

| Benefit | Explanation |

| Time-Saving | – Automated check deposit services save time by eliminating the need to visit a bank to deposit checks manually. |

| Enhanced Safety | – These services provide a secure transaction channel, reducing the risk of check loss or fraud. |

| Improved Efficiency | Automated check depositing minimizes human error, increases transaction accuracy, and speeds up the process of depositing checks. |

Investing in automated check deposit services could be your business’s strategic move to stay ahead of the curve. So, it’s logically a pursuit that companies need to consider undeniably!

How to Check Deposit Works

When it comes to doing business, efficiency matters. Embracing automation can drastically enhance the speed and accuracy of your financial transactions. One such automation worth considering is an automated check deposit service.

Here is a brief overview of how such a system works.

1- Scan:

Checks are scanned at our secure facilities.

2- Review:

Review your scanned checks online. Tell us what and where to deposit.

3- Complete:

We electronically endorse your checks and finalize your deposit slip.

4- Get paid:

Your prepared deposit is sent to your bank.

Convenience and Efficiency

As business owners, efficiency and convenience should always be at the top of our minds. One aspect of business life that can be improved mainly by these two factors is the manner of processing and securing business receipts and payments.

Thankfully, the days of physically going to the bank and enduring the long, tiring process of depositing checks are gone. This is where an automated check deposit service becomes a game changer.

Saving time and improving cash flow with remote check deposit

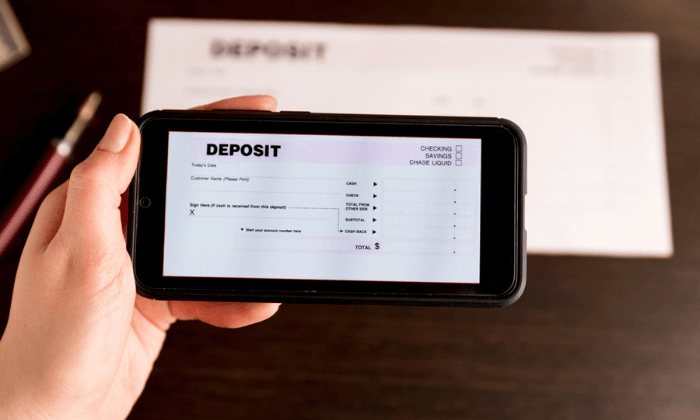

Introducing remote check deposit services has wholly revolutionized the banking experience for businesses. With automated check deposit services, all it typically takes is a scanned image or a photo of the front and back of the check using a mobile app or a desktop scanner.

The convenience of this service is unparalleled – it saves time by eliminating the need to visit a bank physically. Furthermore, it optimizes the business’ operational efficiency as the system automatically updates and records any deposit, significantly reducing the chances of human error.

Seamless banking flexibility and accessibility

Banking as we know it has moved beyond brick-and-mortar establishments and now thrives in the digital realm. Automated check deposit service is banking flexibility and accessibility personified. It allows businesses to manage their finances from virtually anywhere as long as they have a device with internet access.

Moreover, the whole process can be accomplished quickly, and the funds are typically available in the account within a few hours. Quick access to funds dramatically improves cash flow, which is essential for business growth and continuity.

Here’s a summary table of the benefits:

| Benefit | Explanation |

| Saving time | Eliminates the need to go to the bank, making bank transactions faster physically |

| Improved cash flow | Faster clearance and availability of funds once the check is deposited |

| Banking flexibility | This can be done from virtually anywhere |

Pundits believe in digital transformation in all business fields. Utilizing an automated check deposit service is a small but consequential aspect of such transformation.

Enhanced Security and Accuracy

For modern businesses, managing financial transactions requires robust mechanisms that guarantee security and accuracy. One such mechanism offering these substantial benefits is an Automated Check Deposit Service.

This technological advancement simplifies managing checks and improves security and accuracy.

Digital Depositing for Minimized Risk of Lost or Damaged Checks

Key among the strategic benefits of automated check deposit services is the minimized risk associated with lost or damaged checks. Traditional handling of physical checks comes with its share of risk. For instance, checks can get lost in transit or the office.

Furthermore, they are prone to physical damage, including tearing, stains, cuts, or even water damage.

On the other hand, an automated check deposit system mitigates these risks. Once checks are scanned and digitally uploaded into the system, they are immediately safe and secure. There’s no fear of loss or damage, ensuring the financial transactions continue smoothly and efficiently.

Increased Accuracy Through Automated Data Entry

Manual data entry and check processing have long been sources of errors and inaccuracies for businesses. Misread characters, transposition errors, and manual erasures can lead to incorrect payments and ensuing complications.

An automated check deposit service alleviates these concerns. It automatically captures all essential information from a scanned check and eliminates the risk of human error. Imagine a world without typos and data entry errors!

This increased accuracy simplifies check processing for your accounting department and enhances overall business operations.

Take-away table

| Benefit | Summary |

| Minimized Risk of Lost or Damaged Checks | Thanks to digital scans and uploads, an automated check deposit service protects checks from physical loss or damage. |

| Increased Accuracy | The automated data capture from scanned checks bypasses human errors from manual data entry, leading to higher accuracy in financial transactions. |

These were key reasons to consider using an automated check deposit service in your business. Automation is no longer an option but a necessity, and when it comes to managing checks, the ease, safety, security, and accuracy it provides are irrefutable. With such benefits, who wouldn’t want to automate?

Cost and Productivity

In the digital transformation era, businesses leverage technology to streamline their operations and increase efficiency. Among various digital tools available, an automated check deposit service stands out as a game-changer, particularly regarding cost and productivity benefits.

Reducing expenses on manual check processing

Reducing Expenses: Manual check processing can drag your company’s resources. It involves staff sorting mail, opening envelopes, extracting checks and slips, processing them, and finally taking them to the bank.

This time-consuming process comes with administrative costs that can escalate quickly.

With a check deposit service, these activities are automated, thus reducing staffing costs, supply costs, and even banking fees.

Increased productivity and focus on essential tasks

Boost Productivity: Automation of check deposits allows staff members to spend their time on strategic functions rather than operational tasks.

By automating monotonous tasks like check handling, employees can focus more on essential functions, such as customer service or business development.

This means they’re maximizing their productivity, adding more value to the business.

Focus on Crucial Tasks: Automated check deposit makes managing and tracking financial transactions easier. The time saved can be utilized to implement innovative strategies and focus on the business’s core areas.

The table below summarizes the benefits of using an automated check deposit service for business:

| Benefits | Explanation |

| Reducing expenses on manual check processing | – Lower staffing costs: The automated process reduces the need for staff to sort mail, open envelopes, and process checks.

Lower supply costs: Paper, ink, and other supplies associated with manual check processing are not needed. – Lower banking fees: Automated deposits can often reduce fees associated with regular bank deposits. – Boost productivity: Automation allows staff to focus on strategic tasks. – Focus on crucial tasks: The time saved from not manually processing checks can be used to implement innovative strategies and focus on key business areas. |

Thus, automating check deposits can significantly benefit businesses, particularly in reducing costs and boosting productivity.

The advantages of adopting an automated check deposit service

Convenience is an instant payoff when a business uses an automated check deposit service. Its use allows checks to be deposited anytime, eliminating the need to visit a bank during specific hours. This ensures that businesses can maintain steady cash flow; by accelerating the deposit process, businesses can gain quicker access to the funds they need for daily operations.

Reduced risk is another added advantage. Minimizing human handling reduces the likelihood of check fraud or the possibility of checks being misplaced or damaged. The software used in such services usually includes a feature for verifying the authenticity of checks, providing an additional layer of protection.

Efficiency, too, is greatly improved through automated check deposit services. The service can typically process a large number of checks simultaneously, reducing the amount of time needed to deposit the checks.

Partnering with reliable service providers

Local banks and financial institutions often provide such services to businesses. However, to maximize the benefits, businesses should partner with service providers proven to be reputable and reliable. It’s also recommended to assess the level of customer service these companies provide and their capacity to handle the volume of transactions typical for your business.

In light of these benefits, businesses should adopt automated check deposit services. This move promises to save time, increase efficiency, and, above all, drive the modernization of business processes.

Eliminate Stress with Faster Payments; Try Automated Check Deposits Today

Automated check deposit service is a game-changer for businesses.

As a business owner, you undoubtedly know the hassle of manually processing checks. It’s time-consuming and a burden that leaves room for errors.

Using Automated Check Deposit services simplifies your financial management and significantly reduces stress.

This innovative service automatically submits check payments into your bank account, eliminating the need to visit a bank.

This constraint-free process allows your business faster access to cash flow by accelerating payment clearing times.

Speedy check processing impacts your revenue positively and allows the smooth functioning of your business operations.

With a dependable automated check deposit service, you need not worry about theft or loss that can occur with physical checks.

This method offers enhanced security, allowing you to deposit checks anytime from any location.

It uses innovative technology to ensure higher accuracy, therefore tackling the problem of manual errors that could impact customer relationships and lead to financial loss.

Conclusion

The modern business environment requires a seamless blend of convenience and efficiency. Businesses today notably demonstrate this quality in their use of automated check deposit services.

Thank you for reading about the benefits of using an automated check deposit service for your business.

We value your feedback and are excited to hear from you.